Avoid Sideways Market in Your Auto Trading Strat

While automating a Potentially profitable strategy you might lose all your profits in the Sideways or Congested market Movement as your strategy cannot spot unfavorable market conditions to temporarily halt entering Trades. Here you will see just the right Indicators you can add to your strategy to maximize your profits.

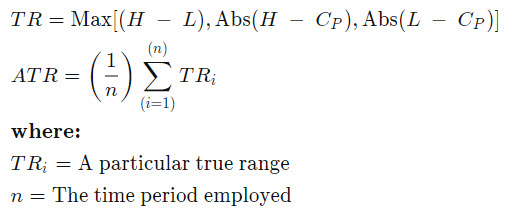

ATR(Average True Range)

ATR is short for the Average True Range. It takes into account price gaps and the average size of candles over a period. Here is the exact formula if you are curious.

You may be wondering, How can I use this Indicator to filter sideways / congested Market movement. The answer is simple to set a minimum value that ATR needs to be before The Strategy can enter new trades.

This works because ATR uses Candles size to determine its value,i.e, when candles are small ATR is low and vice versa, added there are also a few major determinants as well to it.

ATR works independent from the price, This means that no matter the market moves up or down it will present you with valid indications.

ATR is aslo used to set StopLoss. You can set your stop loss equal to 2xATR., Doing so will put your StopLoss out of the regular movement range of the price minimizing the chances of striking it.

You can experiment or go back and look into sideways market conditions to see where ATR stands and use it as a reference to set the minimum value for your strategy.

Hope this was useful, let me know in the comments, about your thoughts.

Really helpful Thanks!!!

ReplyDelete